Managing personal finances can often feel like a daunting task, but with the right tools, it becomes a lot easier and more efficient. Quicken is a leader in financial software, offering a range of products designed to help individuals keep track of their spending, budget effectively, and even plan for the future. Whether you’re looking to get a better handle on your daily expenses or manage investments, Quicken has the solution for you. Let’s dive into how Quicken can transform your approach to money management.

Why Choose Quicken?

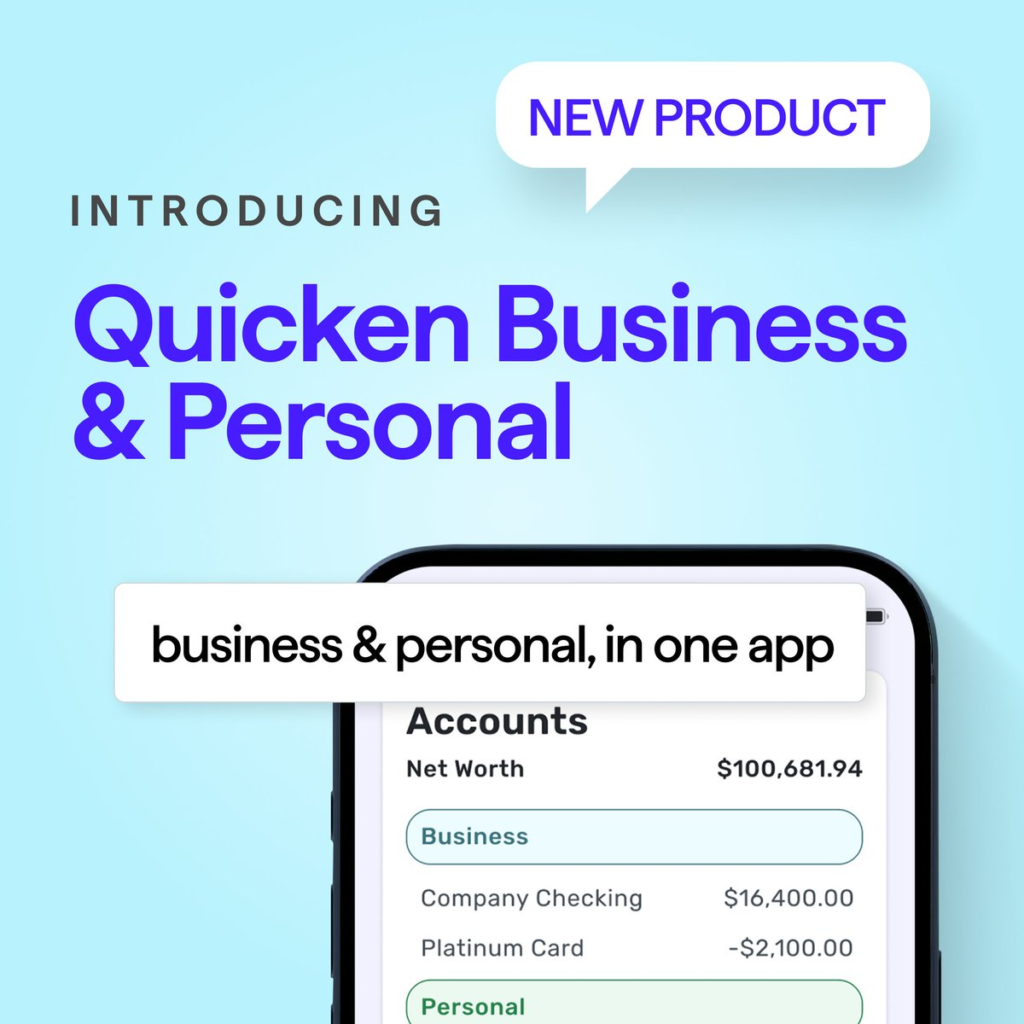

Quicken isn’t just another finance app—it’s an all-in-one financial management system that caters to individuals, families, and even small businesses. With over three decades of experience, Quicken has evolved to offer advanced features and support for every aspect of personal finance.

- Expense Tracking & Budgeting: Automatically categorize your transactions and set budgeting goals.

- Investment Tracking: View and manage your investments in one place.

- Bill Pay & Alerts: Set reminders for due dates and track payments.

- Tax Preparation: Easily track tax-deductible expenses and generate reports for tax season.

Quicken’s easy-to-use interface ensures that you can monitor your finances with minimal effort. Click here to explore Quicken’s features.

The Benefits of Using Quicken

- All-in-One Financial Management

With Quicken, you can link all your bank accounts, credit cards, and even investment accounts. It consolidates everything into one easy-to-read dashboard, so you never have to log into multiple websites or apps to get a full picture of your finances. Get started with Quicken today. - Customizable Features

No two financial situations are alike, which is why Quicken allows users to personalize their experience. Whether you’re saving for a home or planning for retirement, Quicken gives you the flexibility to set specific goals and track your progress in real-time. - Secure & Private

Security is a top priority when managing sensitive financial information. Quicken uses encryption and multi-factor authentication to ensure that your data remains safe at all times.

How Quicken Helps You Save Time & Money

We all know time is money. Quicken saves both by streamlining your financial tasks. Here are some examples of how Quicken helps:

- Automatic Syncing: Sync your bank transactions automatically and categorize them into pre-set categories to save time on data entry.

- Bill Management: Set up bill reminders so you never miss a payment and avoid late fees.

- Tax Optimization: Track deductible expenses and maximize your tax savings by having all relevant information in one place.

Take control of your finances with Quicken and start saving today!

Conclusion

If you’re looking for an easier way to manage your finances and take control of your financial future, Quicken is the tool you need. From budgeting and tracking expenses to investment management and tax planning, Quicken is the comprehensive solution that makes managing money easier and more efficient. Take the first step toward financial freedom today with Quicken.